Turn On, Tune In, Buy Out: Who Follows AbbVie Into Psychedelic M&A?

A recent Bloomberg article reported that AbbVie plans to acquire a psychedelic drug developer for $1bn, bringing new attention to a category that analysts expect to produce multiple blockbuster drugs

According to the Wall Street Journal last week was the busiest week across industries for deal making since 2021 and the period is shaping up to be a ‘Scorching Hot Summer for Deals on Wall Street’. Biotech investors were encouraged by rumors that one of the world’s largest pharma companies, AbbVie, is in talks to acquire the private biotech Gilgamesh Pharmaceuticals for roughly $1 billion.

Such a deal would hand AbbVie two phase 2 psychedelic-based drugs for depression and anxiety, signaling that Big Pharma may finally be ready to go all-in on this field. Indeed, share prices of publicly traded psychedelics companies such as atai Life Sciences (NASDAQ: ATAI) jumped on the news by up to ~20% (see graph below).

Recent biotech equity market reports highlight that, driven by late-stage trial successes, accelerating regulatory momentum, and the growing unmet need in mental health (affecting over 1 billion people globally), large pharmaceutical companies are showing renewed and growing interest in psychedelic drug developers. In addition, valuations of these biotechs still appear attractive when measured against valuation of peers, expected peak sales multiples and their historical share prices.

Drawing a parallel to the rapid adoption of GLP-1s, we expect that most pharma companies will eventually pursue psychedelics and neuroplastogens, given their broad therapeutic potential. Following Eli Lilly’s and Novo Nordisk’s early breakthroughs with GLP-1 agonists, nearly every large and mid-sized pharma now has a GLP-1 pipeline - even those with no prior focus on diabetes or obesity.

However, not every big pharma will leap into psychedelics yet. Many large drug makers historically backed away from neuroscience and psychiatry due to high risks and past failures. This caution paired with residual stigma surrounding psychedelic compounds could keep the pool of potential buyers initially relatively narrow.

Below, we identify for which commercial-stage pharmaceutical players an acquisition of a mid-late-stage asset or company like atai Life Sciences (ATAI), Compass Pathways (CMPS), MindMed (MNMD), GH Research (GHRS) or prominent private startups (e.g. Transcend Therapeutics, Delix Therapeutics and Gilgamesh) make most sense already today, and why they might make a move into this field within next 6 - 12 months.

10 Shortlisted Pharma Players with Varying Stakes in Neuropsychiatry

To narrow-down the field of potential acquirers of psychedelic assets, we selected a sub-sample of ten commercial-stage large pharma companies that have either (1) already one or more neuropsychiatric drugs on the market or in late-stage development, or (2) announced to strategically focus and grow their R&D and/or commercial activities in Psychiatry or Neurology.

This approach let us to short-list the following companies: Lundbeck, Otsuka, J&J, Takeda, AbbVie, Biogen, Roche, Novartis, Bristol Myers Squibb (BMS) and Boehringer Ingelheim (BI). While we do see a strategic rationale also for medium-sized CNS-players like Supernus Pharmaceuticals or Neurocrine Biosciences to acquire psychedelic assets or companies - with the exception of Lundbeck (due to its European footprint and strong legacy in psychiatry) - we excluded companies with a market cap significantly smaller than $20bn from this analysis.

The graph below summarizes the total 2024 revenues (shown on top of each bar) and the revenue breakdown per therapeutic areas (TAs) of each of companies we shortlisted. The graph is sorted by the company with the highest percentage of their revenues in Psychiatry followed by Neurology to illustrate the degree of commercial footprint in neuropsychiatry of each company. Reading left-to-right therefore shows how “CNS-centric” the commercial footprint is - from Lundbeck’s pure-play CNS portfolio to BMS’s oncology-dominated mix.

Note: As BI does not disclose a therapeutic area break-down of its 2024 revenues of $27.73bn, the company is not shown in the graph above. In addition, J&J’s total revenue were $88.8bn across all segments, $57bn refers to revenues from J&J’s ‘Innovative Medicine’ (pharma) segment only.

What jumps out: In 2024, only three companies generated more than a third of their revenue from neuropsychiatry: Lundbeck (72 % Psychiatry, 28 % Neurology) and, at a very different scale, Otsuka (36 % Psychiatry) and Biogen (65 % Neurology). Everyone else was in the single-digit to low-teens range, meaning psychedelics would be either a bolt-on (for the CNS specialists) or a diversification move for the larger immunology and inflammation- as well as oncology-heavy groups.

The Framework we then applied to assess the likelihood of these companies to engage in M&A activities in the psychedelics space in the near-term:

Strategic and Cultural fit, i.e. who has a strong (commercial) footprint in psychiatry and/or plans to grow in (interventional) psychiatry and who has the bold innovator culture that allows a company to pursue along stigmatized and mechanistically not fully mapped-out drug class like psychedelics

Commercial and Late-stage R&D capabilities, i.e. who has the capabilities to develop and launch psychedelic-based interventional psychiatry treatments

Pressure to Transact in Near-term, i.e. whose revenues are most at risk because of upcoming loss of exclusivity of their revenue-driving drugs and who cannot rely on internal pipeline candidates alone to make-up for looming patent cliffs

Balance Sheet Strength, i.e. who has the financial resources to successfully execute a 1bn+ dollar transaction within the next 6-12 months - looking at cash reserves, net debt and other balance sheet metrics to assess ‘M&A capacity‘

Growth DNA - Inorganic vs organic growth preferences, i.e. who has a proven track-record growing inorganically through M&A activities vs tendency to grow organically by developing ‘home-grown’ assets (internal pipeline)

Take-away: J&J, AbbVie and Otsuka Emerge as Most Likely Buyers, Lundbeck Close Behind

The composite view yields a clear top group of likely acquirers: J&J, AbbVie and Otsuka, closely behind Lundbeck; Of this group J&J has least time-pressure to act; a second tier (Biogen, BMS) screens as plausible but less consistent; Novartis and Boehringer Ingelheim are financially able but strategically less aligned; Roche and Takeda appear least likely in the next 6–12 months. See the outcome table below for the full ranking.

Ratings in table explained: ++: very high, +: high, o: medium, -: low, - -: very low

Two factors separate the leaders - Fit and capabilities: J&J is the only incumbent with an approved psychedelic and interventional psychiatry product (Spravato) and a existing launch muscle to scale psychedelic therapies (however it not made any public comments yet to expand beyond Spravato into (classic) psychedelics; AbbVie has rapidly assembled neuropsychiatry capabilities via Allergan assets (incl. Vraylar), Cerevel, and the Gilgamesh collaboration; Otsuka of all is certainly most bullish on psychedelics and has made the most explicit, multi‑year commitment to “medical psychedelics” through investments and acquisitions (incl. Compass, Mindset); Lundbeck brings deep psychiatry heritage and commercial know‑how, albeit sofar with a wait‑and‑see posture. By contrast, BMS is just rebuilding its CNS capabilities (Karuna), Biogen’s psych focus remains active yet selective (it bid to acquire Sage earlier this year), and Novartis, Roche, Takeda, and BI show limited late‑stage, interventional‑psychiatry R&D and commercialization infrastructure today.

Pressure (looming patent cliffs, internal pipeline strength), balance sheet capacity, and inorganic growth DNA then determine who is most likely to move first. Patent‑cliff exposure (especially in neuropsychiatry) and/or concentrated and risky late‑stage pipelines raise urgency for several players (e.g., AbbVie, Otsuka, Lundbeck, BMS Biogen), while BI, J&J, Roche, Novartis and Takeda face less immediate pressure. Financially, J&J, Roche, Novartis, Otsuka, Biogen, and BI have deal headroom; AbbVie, BMS, and Takeda can still transact but are more debt‑sensitive; Lundbeck has the tightest near‑term capacity post‑Longboard. Finally, dealmaking patterns favor Novartis, AbbVie, and BMS (high inorganic velocity), with J&J close behind; Biogen and Lundbeck (the latter historically prefered partnerships such as with Takeda and Lundbeck) are selective; Takeda paired back deal activity in neuropsychiatry over the last years and Roche and BI generally prefer organic or early‑stage routes.

Net‑net: J&J, AbbVie and Otsuka are the most probable buyers, with J&J being under least time pressure of these three to act now; Lundbeck is from a strategic rationale a highly logical buyer but constrained by scale/financing and often chooses partnerships over acquisitions; Biogen/BMS are credible situational bidders; Novartis/BI are financially able wildcards; Roche/Takeda are unlikely near‑term.

See sections 1–5 below for the underlying scoring, company deep dives on strategy and capabilities, pipeline/patent‑cliff exhibits, and balance‑sheet analysis.

1. Strategic and Cultural Fit to Successfully Develop and Commercialize Psychedelics

Collectively, the 10 short-listed companies above are all established leaders in CNS therapeutics, yet they differ in how strategically aligned and bullish they are with respect to psychedelic drug development and commercialization.

Otsuka has actively invested in and acquired psychedelic-focused ventures over the last five years. It was the first pharma company to invest in this field by funding psilocybin therapy pioneer COMPASS Pathways in 2020 and partnered with then bought Mindset Pharma for its psychedelic compound pipeline. Otsuka’s leaders explicitly speak to the promise of “medical psychedelics” and have made psychiatry a top priority. No other big pharma has put as much capital and public endorsement into psychedelics as Otsuka. Former Otsuka Pharmaceuticals US CEO Kabir Nath joined COMPASS Pathways as the company’s CEO in 2022 and Robert McQuade, at the time Otsuka’s EVP, Chief Strategic Officer (now board member of Otsuka US), joined COMPASS’ board of directors in 2020.

AbbVie made a major 2024 deal to develop “next-generation” psychedelic-inspired drugs (neuroplastogens) with Gilgamesh, committing up to $2 billion in biobucks suggests they see psychedelics (and their analogs) as a logical extension of treating depression and other refractory conditions – despite initially being hypersensitive to the vocabulary used to describe the Gilgamesh deal. AbbVie’s R&D head openly stated the need for “novel…approaches” in psychiatry and is embracing neuroplasticity mechanisms. This marks a significant bullish entry into the field, even as the CEO tempers expectations for their overall psych investment after its recent Cerevel acquisition for $8.7bn. AbbVie’s substantial financial stake and strategic framing of psychedelic-rooted neuroplastogens and AbbVie’s current rumored take-over talks with Gilgamesh place it near the top of the list in terms of strategic alignment.

J&J pioneered the psychedelic/dissociative drug esketamine (Spravato) for depression and secured FDA approval in 2019 for this novel interventional psychiatry treatment. This approval in many ways kicked off the current wave of interest in fast-acting, psychedelic treatments. J&J demonstrated that regulators would approve an unconventional CNS drug, and it continues to study Spravato’s long-term benefits. With Spravato sales growing more than 60% YoY in Q2 2025 in the US and Spravato having now an annual global sales run rate of ~$1.7bn, J&J has the most knowledge, the commercial ‘machine’ and experience when it comes to successfully launching and scaling an in-clinic psychedelic treatment. Sofar, J&J has not highlighted new psychedelic projects beyond Spravato. Its bullishness is rather evident in action (having commercialized a “psychedelic adjacent” therapy). Near-term M&A moves in the psychedelics space will partly depend on J&J’s thinking on weather a longer-duration ‘first-generation’ psychedelic like COMP360 or MM-120 (with 6h+ of required in-clinic stays) could be successfully co-positioned or synergistic with Spravato (we certainly think so – more in upcoming blog posts).

Companies like Lundbeck and Biogen, entirely dedicated to psychiatry and neurology respectively, are also a natural fit in principle. CNS pure-play company Lundbeck has a 70 year legacy in psychiatry and needs breakthrough therapies in depression/anxiety, especially if late-stage pipeline assets fail. Publicly, Lundbeck has not jumped into psychedelics, likely due to its smaller size and need to manage financial risk after the Longboard Pharma acquisition for $2.6bn. In addition, Lundbeck often likes to partner with players such as Otsuka when it comes to commercializing innovative products. While Biogen hasn’t pursued classic hallucinogens, it invested heavily in rapid-acting antidepressant via Sage’s zuranolone. This signals belief in novel neuropsychiatric therapeutics that share the “rapid neuroplasticity” ethos of psychedelics. However, recent commentary from leadership on capital allocation to external innovation and focus areas (immunology, rare diseases) as well as commentary from its research chief Jane Grogan in 2023 make Biogen a less likely candidate for a large-scale psychedelics M&A deal at this time but they could still be an interesting partner for a licensing transaction or a commercialization partnership.

On the other hand, some companies are less suited or more hesitant to jump into psychedelics due to strategic focus or organizational mindset. BMS, for instance, had largely exited neuroscience and only now is gingerly returning after the Karuna Therapeutics acquisition– a rather novel and complex area like psychedelics is not an easy fit for a company still rebuilding CNS expertise. Similarly, Roche and Novartis concentrate on neurologic diseases and targeted therapies (like gene therapies or precision medicine) – the model of interventional psychiatry sessions with psychedelic drugs may not mesh with their short-term priorities or core strengths. Takeda has narrowed its CNS scope to specific niches (e.g. sleep disorders, rare neurology) and shed broad psychiatry programs, indicating limited appetite for the complexities of psychedelic-assisted therapy development. Finally, a research-driven firm like BI may find psychedelics outside its comfort zone unless they can be made to fit into a precision, mechanism-based framework.

In summary, companies with a clear stake in psychiatry (Otsuka, J&J, AbbVie, Lundbeck) are especially well-positioned to advance and commercialize psychedelic drugs in the near-term - they have the expertise, patient focus, commercial teams and motivation to innovate in this arena. In contrast, those whose CNS efforts center on neurology or who are only cautiously engaging in psychiatry (Biogen, BMS, Roche, Novartis, Takeda) appear less naturally aligned and may abstain or lag until the field becomes commercially too significant to ignore and more clinical evidence in neurological disorders emerge.

2. Psychedelic-specific Late-stage R&D and Commercial and Capabilities

J&J has first-hand experience in navigating the clinical, regulatory, and logistical challenges of an interventional psychiatric treatment (Spravato requires in-clinic administration, safety monitoring and REMS, similar to how future psilocybin/MDMA therapies may be delivered). As mentioned, beyond Spravato, J&J just bolstered its neuroscience portfolio by acquiring Intra-Cellular Therapies (Caplyta) for $15 billion – giving it a marketed antipsychotic for bipolar/schizophrenia and a pipeline including non-hallucinogenic psychedelic analogs. J&J’s historical CNS expertise (it developed older drugs like Risperdal and Topamax) combined with its current pipeline and products make it exceptionally capable of developing and launching psychedelic-based interventional treatments. It certainly has the commercial infrastructure and know-how (sales force specialized in psychiatry) ready to roll - as evidenced by Caplyta and Spravato’s ongoing success.

Otsuka has a strong legacy in psychiatry. It developed and launched the blockbuster antipsychotic Abilify (aripiprazole) worldwide and continues to market derivative products (Abilify Maintena, etc.). It also co-develops Rexulti (brexpiprazole) with Lundbeck for depression adjunct therapy and Alzheimer’s agitation. Otsuka has demonstrated capabilities and interest in interventional psychiatry, including psychedelic-like mechanisms (ketamine analogues, psilocybin analogues). With its proven ability to navigate FDA approvals (it won approval of Abilify Asimtufii, a long-acting injectable, in 2023) and to market psychiatric drugs globally, Otsuka is well positioned to develop and launch a psychedelic-based treatment.

Lundbeck has over 70 years of experience in neuroscience, and it has brought multiple psychiatric drugs to market (e.g. antidepressants Celexa/Lexapro and Trintellix, antipsychotics like Abilify Maintena and Rexulti in partnership with Otsuka). This demonstrates strong know-how in developing and launching psychiatric treatments. Its expertise in mood disorders would be highly relevant if it acquired a psychedelic asset (e.g. for depression), but so far it has taken a wait-and-see stance on psychedelics. Given their focus on partnerships in the past, it would not come as a surprise to see them enter the space via this route (similar to previous partnerships with Otsuka).

AbbVie historically was not a major player in psychiatry – its portfolio has been dominated by immunology (Humira) and oncology. However, with the 2020 acquisition of Allergan, AbbVie inherited some neuroscience assets (e.g. Botox for migraine and a pipeline of CNS drugs). Allergan had run clinical programs on rapid-acting antidepressants (like rapastinel, an NMDA modulator, though that failed in trials). While AbbVie itself has not launched any psychiatric drugs to, it now has a growing CNS division and appears to be strategically building a neuropsychiatry pipeline. With Allergan’s legacy and new deals and it’s commercial footprint around the blockbuster drug Vraylar (cariprazine) that is approved for schizophrenia, bipolar I disorder, and as an adjunctive treatment for major depressive disorder, AbbVie likely has the necessary R&D, regulatory and commercial expertise to successfully develop and commercialize psychedelic-based treatments.

Biogen has traditionally been focused on neurology (multiple sclerosis, ALS, Alzheimer’s). It has relatively limited experience in psychiatric medications. In 2020, Biogen did enter a collaboration with Sage Therapeutics. They co-developped zuranolone, a novel rapid-acting antidepressant that was approved for PPD but rejected for MDD in 2023, giving Biogen a toehold in the depression market. In 2023, Biogen’s research leadership explicitly stated that psychedelics are not a focus area for the company emphasizing that Biogen has a “very limited, very focused effort in neuropsychiatry”. This suggests that capability-wise, Biogen would have to acquire or partner for expertise if it wanted to work on psychedelics.

BMS had largely exited CNS drug development in the 2010s. Famously, BMS co-marketed Abilify with Otsuka until 2015, then sold its stake and focused on oncology and immunology. For years, BMS had no marketed psychiatry drugs and minimal CNS drug development capabilities. This changed dramatically in late 2023, when BMS announced a $14 billion agreement to acquire Karuna Therapeutics. Today, BMS seems to be betting on neuropsychiatry again, which implies it will have the internal know-how (via Karuna’s team and BMS’s resources) to handle additional innovative psychiatric therapeutics development and commercialization.

Novartis, Roche, Takeda and BI all have only skeletal late-stage R&D and commercial capabilities for interventional psychiatry today: While Novartis’ public pipeline lists an impressive number of 13 neuroscience assets and none is in late-stage psychiatry. Its last meaningful move in the space (the 2020 Cadent deal) has not yet yielded a registrational program, leaving it without a specialized psych salesforce. Roche has even gone further, scrapping its lone early-phase psychiatric molecule in a 2024 portfolio purge and has not commercialized a new mental-health drug in over a decade, so the regulatory and launch muscle for novel psych interventions is effectively dormant. Takeda still flags “Neuroscience” as a core area, yet it licensed seven mid-stage psychiatry projects (including schizophrenia and TRD assets) to Neurocrine in 2020 and now depends on Vyvanse—whose US sales are collapsing under generic pressure—for any psychiatric commercial presence. Boehringer Ingelheim is the most active R&D-wise, with Phase III (now negative) GlyT-1 inhibitor iclepertin and early NR2B-NAM BI-1569912, but lacks an approved psychiatric product or a dedicated field team, meaning substantial scale-up would be required before launching psychedelic-based or other interventional therapies.

3. Near-term Pressure to Transact - Internal R&D Pipeline Maturity/Quality and Looming Patent Cliffs

The chart below shows where each company is placing its late-stage internal development bets and how many late-stage assets they have. The latter can be seen as a proxy for how dependent these companies are on sourcing external innovation from biotechs, especially if key internal assets fail in Phase 3.

Roche towers over the field with a diverse set of an remarkable 30 Phase 3 or Phase 3-ready projects in total, including six in neurology and 24 in non-CNS areas, confirming its status as the broadest internal pipeline among large pharma. Biogen, by contrast, is highly concentrated: its eight neurology assets (e.g., sub-cutaneous lecanemab for Alzheimer’s, tofersen for ALS and prasinezumab for Parkinson’s) give it the largest pure-neuro late-stage portfolio, while activity outside the CNS is minimal. Otsuka stands out in psychiatry with three active Phase 3 programs (brexpiprazole for PTSD, the TAAR-1 agonist ulotaront for schizophrenia, and centanafadine for ADHD), more than any other company on the list. The former, Brexpiprazole, however recently experienced a setback - with a 1-10 negative vote the FDA Advisory Committee did not recommend brexpiprazole with sertraline for PTSD due to insufficient efficacy evidence. At the opposite extreme, both BMS and BI are pursuing only non-CNS indications at this stage, reflecting their historical focus on oncology, cardiovascular and metabolic diseases.

Several noteworthy drugs underpin the numbers. Lundbeck’s single psychiatry asset is the partnered brexpiprazole PTSD filing, but its neurology bar now captures bexicaserin, an oral 5-HT2C super-agonist in a global Phase 3 “DEEp OCEAN” trial for developmental and epileptic encephalopathies (DEEs). Takeda’s neurology tally is driven by soticlestat, the cholesterol-24-hydroxylase inhibitor in Phase 3 studies for Dravet and Lennox-Gastaut syndromes. AbbVie’s lone neurology project is tavapadon, a once-daily D1/D5 partial agonist that recently hit its primary endpoints in the TEMPO program for early Parkinson’s. Roche’s six neuro assets include the Bruton-tyrosine-kinase inhibitor fenebrutinib in three pivotal multiple-sclerosis trials, while J&J’s sole psychiatry entry is the orexin-2 antagonist seltorexant for MDD with insomnia.

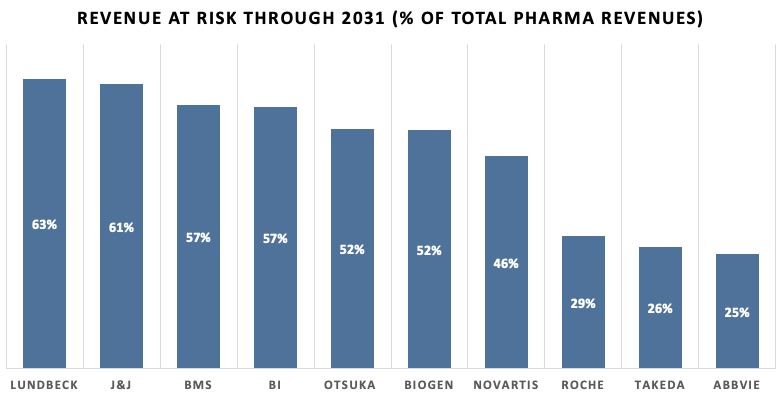

When, as a next step, looking at pharma revenues at risk due to loss of exclusivity through 2031, the left side of the chart below is dominated by companies whose neurology / psychiatry or immunology franchises hit the patent cliff first. CNS-only player Lundbeck tops the list (63% of sales at risk) because its once-monthly antipsychotic Abilify Maintena already lost exclusivity with generics expected to erode revenues quickly, and antidepressant Trintellix follows in 2026–27. J&J (61%) is close behind: blockbuster Stelara faces U.S. biosimilars from February this year, while Xarelto (2025-26), Darzalex (≈ 2028) and shared oncology asset Imbruvica (≈ 2028) line up next. BMS and BI (both 57%) owe their high percentages to a single mega-drug: Eliquis for BMS (generic entry April 2028) and Jardiance for BI (key patents lapse 2025, with generics already multiplying in India). Otsuka and Biogen (52%) each hinge on psychiatry and neurology respectively: Otsuka’s risk is the same Abilify Maintena cliff as with Lundbeck plus possible tolvaptan erosion after 2026, whereas Biogen’s exposure centres on Tysabri, whose first biosimilar (Tyruko) is FDA-approved and could launch once remaining patents expire in 2027.

In the middle of the pack sits Novartis (46%), where two blockbusters roll off patent almost back-to-back. A Delaware ruling now allows a generic of heart-failure juggernaut Entresto (2024 sales ~$7.8 bn) to reach the U.S. market as early as July 2025; meanwhile IL-17 antibody Cosentyx is expected to face biosimilars between 2028 and 2029, together putting roughly ten billion dollars of annual revenue in jeopardy. Although Roche has already weathered the Rituxan/Herceptin/Avastin storm, it still shows 29% because its fastest-growing drug, Ocrevus (MS), reaches the end of its 12-year U.S. exclusivity in March 2029 and oncology biologics Perjeta/Kadcyla follow around 2027-28. Takeda (26%) is exposed mainly to ADHD stimulant Vyvanse, whose U.S. patent expired in August 2023, and to upcoming biosimilars for gut biologic Entyvio after 2026. AbbVie’s seemingly modest 25% masks the fact that the steepest part of the Humira cliff – once more than $20bn a year – is already in progress following the 2023 U.S. biosimilar wave; the remainder of its risk curve stems from oncology partner drug Imbruvica later in the decade.

4. Financial Capacity and Balance Sheet Strength: Who Can Afford a $1B+ Deal in the Near-term?

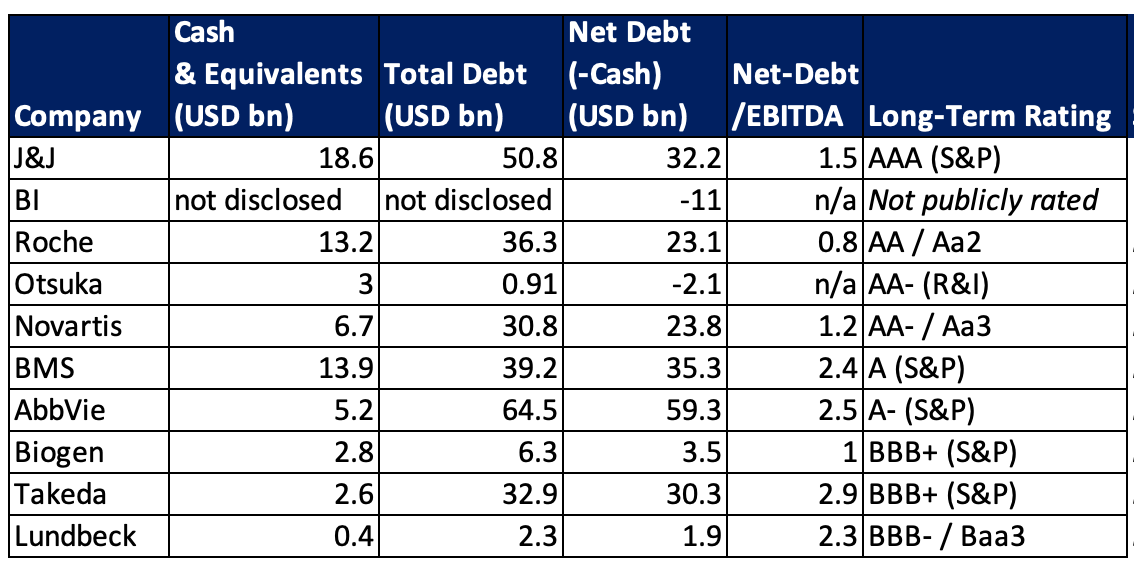

All the listed companies have in principle the financial capacity – in varying degrees – to execute a $1 billion-plus acquisition in the next 6–12 months. J&J, Roche, Novartis, Otsuka, Biogen, and Boehringer Ingelheim have substantial liquidity or net cash positions and strong credit ratings, making a $1bn+ deal comfortably feasible. AbbVie, BMS, and Takeda carry higher debt loads, but their large cash flows and investment-grade ratings suggest that a $1bn acquisition is still likely manageable (though these firms may be more debt-sensitive and thus prudent in structuring such a transaction). Lundbeck, while financially stable, has the tightest headroom due to its recent leverage increase; it could pursue a $1B deal, but would probably need external financing or partnering to maintain balance-sheet health. Below graph ranks the companies from high to low $1bn+ deal headroom.

J&J (AAA rating as of 2025) ended Q2 2025 with about $19bn in cash and marketable securities and $51bn in debt (net debt ≈$32bn). Its net debt-to-EBITDA is solid (~1.5×), and the company generates robust free cash flow. With its pristine balance sheet and AAA credit, J&J has more than enough financial capacity.

BI is a financially conservative private company. It generated €26.8bn in sales in 2024 and typically carries little debt. BI reinvests heavily (e.g. €5.7 bn R&D in 2024) and has no public shareholders expecting dividends, so it retains earnings to fund growth. With its strong cash position and lack of leverage, Boehringer Ingelheim has significant financial firepower.

Roche’s half-year 2025 net debt stood at about $26bn (up from $21.4bn at end-2024, due largely to a $9.8bn dividend payout). Roche enjoys a AA/Aa2 credit rating and substantial cash flows. Its net debt/EBITDA ratio is with 0.86 very low and also its total net debt is relatively low for its size (sales ~$38.3bn in H1 2025). Roche’s strong credit profile and liquidity allows for major M&A activity.

Otsuka had cash and equivalents of $3bn versus total debt of about $0.9bn at June 30, 2025. This leaves Otsuka in a significant net cash position ($2+ bn). Combined with strong cash flows ($1.44bn operating cash inflow in H1 2025) and high credit ratings (R&I AA-), Otsuka clearly has ample headroom to pursue significant M&A in the next 6–12 months.

Novartis is in a very strong financial position. After spinning off Sandoz and selling off non-core assets (like a stake in Roche for $20bn in 2021), Novartis accumulated cash and kept a leaner focus. It had about $7bn in cash at end of Q2 2025 and moderate debt (~$24 bn net debt, which is low relative to earnings). The company has also been doing share buybacks, indicating excess capital. A $1 billion acquisition is easily affordable.

BMS had about $13.9bn in cash and $49.2bn in total debt as of Q2 2025 (net debt ~$35bn, post-Celgene). It remains committed to reducing debt – having already paid down ~$6.5bn of the targeted $10bn debt reduction by mid-2025 – and maintains a solid A/A– credit rating. Given its strong operating cash flows and ongoing deleveraging, BMS should have the headroom to finance a $1+ billion acquisition in the next 6–12 months without compromising its investment-grade status.

AbbVie’s balance sheet shows about $5bn in cash against $65bn in debt as of early 2025 (net debt ~$60bn) after major acquisitions (e.g. Allergan) over the last years. Nonetheless, AbbVie produces large free cash flows (>$15bn annually) and has been assigned A–/A3 credit ratings (outlook stable). Its net debt/EBITDA is moderate (~2.5×) and trending down. AbbVie should have the financial flexibility the next year, especially given its ongoing debt reduction and strong cash generation.

Biogen reported $2.8bn in cash and about $6.3bn in total debt as of Q2 2025, which equals roughly $3.5bn net debt (around 1× EBITDA leverage). The company’s free cash flow for Q2 was $134mn, and it maintains a BBB+ credit rating. Biogen’s balance sheet is quite healthy; it likely can readily entertain large-scale M&A via cash on hand and/or new debt without straining its finances.

Takeda is a top-10 pharma by revenue, but it is also heavily indebted from the $62 bn Shire acquisition. It has been working to pay down that debt; its net debt stood around ¥4.9 trillion in March 2025 (≈ $33bn) , with a debt/EBITDA ratio ~3×. This leverage constrains Takeda’s ability to do large acquisitions in the short term – management set a goal to get debt down before making another big purchase. Takeda’s cash on hand is usually a few billion dollars, but a lot of free cash is earmarked for debt servicing and dividends

Lundbeck just recently closed a $2.6 bn all-cash acquisition of Longboard Pharmaceuticals in October 2024, leading to $1.9 bn in net debt by Q2 2025, with cash reserves down to ~$380 mn and leverage at 2.3× EBITDA. While the company secured a €1.5 bn credit facility to preserve flexibility, Q1 free cash flow turned negative due to acquisition-related debt service. As a result, another $1 billion+ deal is unlikely from a risk management perspective and would require further debt or equity issuance.

5. Growth DNA - Inorganic vs organic growth preferences of each company

Several pharma players under review exhibit a strong preference for inorganic growth, which increases their likelihood to pursue psychedelic M&A. J&J, AbbVie, and BMS stand out with consistently high deal velocity and a track record of bold acquisitions, particularly in neuroscience. Novartis also ranks high, reflecting its bolt-on acquisition strategy across core areas. Lundbeck, while smaller, has shown moderate appetite for external growth when assets are late-stage and strategically aligned. Otsuka, Biogen, and Takeda fall into a more balanced or selective category, engaging in M&A opportunistically but not relying on it as a core growth lever. Roche and Boehringer Ingelheim (BI), on the other hand, demonstrate the lowest inorganic growth orientation, historically favoring internal R&D and early-stage partnerships over late-stage or high-value acquisition

AbbVie has been among the most aggressive big pharmas in neuroscience dealmaking in recent years. For example, beyond the Gilgamesh collaboration, AbbVie took a $355 M stake in a genetic medicine biotech for neuro disorders, and as noted, moved to buy Cerevel for $8.7bn. In 2022 it acquired Syndesi (a deal worth up to $1bn) to strengthen neurology. This flurry of deals , a total of 10 since 2022, suggests a high appetite for inorganic growth in CNS. AbbVie’s CEO has publicly stated that the company is interested in “transformational innovation” in areas like neuropsychiatry. The company’s approach is often to start with partnerships/options (as with Gilgamesh) and then potentially acquire if results are promising. AbbVie’s likelihood to pursue a psychedelic-related acquisition – as rumored - is hence high.

J&J has completed 7 deals since 2022, demonstrating appetite for acquisitions, both large and small, as part of its growth strategy. It typically seeks innovation externally when needed – for instance, buying Actelion to get into orphan disease drugs, or Momenta for autoimmune drugs. Its $14.6bn purchase of Intra-Cellular Therapies (including a pipeline of psychedelic derived neuroplastogens) in January 2025 was a major inorganic move to expand its psychiatric drug portfolio, following years of organic work on Spravato and other internal development candidates. It is also an active dealmaker in general (averaging several acquisitions or significant licenses each year). To summarize, J&J has high likelihood to engage in psychedelic M&A – it has the capabilities (already selling a psychedelic-like drug), the money, and a proven appetite to grow inorganically through CNS deals.

Otsuka’ growth strategy has been a mix of approaches: it grew Abilify via an alliance with Bristol-Myers Squibb, acquired Astex (an oncology firm) in 2013, Avanir in 2015 (neurology), and has numerous licensing deals. However, since 2022, Otsuka hasn’t done any notable M&A deals yet, focusing instead on advancing internal projects (it launched brexpiprazole for new indications). Recently, it seems to rather favor collaborations (for example, with Lundbeck on multiple drugs, with digital therapeutics firms, etc.) and smaller acquisitions and investments to access new science such as the Mindset Pharma in 2023 and the Compass Pathways Series B in the psychedelics space.

Lundbeck’s history shows it will use acquisitions to add strategic CNS assets, but typically it targets proven late-stage assets (e.g. Alder’s Phase 3 and Longboards’ Phase 2 assets). It might entertain a psychedelic M&A if the asset is late-stage and aligns with its CNS focus, but as a smaller player with limited cash, it is less likely to be first in a bidding war. Its propensity is to partner (e.g. its alliance with Takeda on Trintellix and with Otsuka on Rexulti and Abilify) and to acquire only sparingly. The Longboard Pharma acquisition was the only deal since 2022. However, with a transaction volume of $2.6bn this deal was a relatively large one given Lundbeck market cap of approx. $5.2bn.

BMS has proven itself to be one of Big Pharma’s most deal-hungry players in recent times. The massive Celgene acquisition in 2019 was followed by a series of bolt-ons to diversify (MyoKardia in cardiovascular, Turning Point in oncology, and now Karuna Therapeutics in neuroscience). BMS is clearly willing to grow inorganically when it sees an opportunity. Its M&A track record is aggressive, but typically spaced out by a year or two for large deals and since 2022 has done “only” 6 deals, a relatively small amount compared to its big pharma peers.

Takeda has certainly demonstrated an appetite for M&A - most dramatically with its takeover of Shire in 2019 to scale up globally. However, after digesting Shire, Takeda’s CEO has signaled a period of restraint on large acquisitions to reduce debt. Since 2022, Takeda’s growth has been mainly organic or through licensing deals rather than big purchases (the $4bn+ Nimbus TYK2 Program deal being the exception). Given its debt load and current focus, Takeda is a lower-likelihood player for psychedelic M&A in the near term.

Biogen’s approach to growth has been a mix of internal R&D and targeted deals (two closed deals since 2020). In the last few years, it focused on Alzheimer’s internally, while supplementing its pipeline via a few acquisitions like Reata (for a neuromuscular drug) and Nightstar (gene therapy) and via collaborations (Ionis for antisense drugs, Sage for depression). While they (unsuccessfully) bid earlier this year to acquire Sage Therapeutics (that has an interventional psychiatry treatment for post-partum depression on the market), representatives recently made publicly comments that psychedelics are not a core focus area for them, suggesting M&A moves into the psychedelics space are rather unlikely at this stage.

Novartis’ CEO has pursued a an aggressive M&A strategy of “focus and bolt-on acquisitions” with a total of 10 acquisitions since 2022 to date. Being financially capable, Novartis’ leadership has been pruning the company to core therapeutic areas and adding assets that strengthen those cores. Neuroscience (especially psychiatry) has not been identified as a core focus recently, which somewhat reduces the likelihood of a big play in psychedelics. However, Novartis does have a history of opportunistic moves – if it sees an emerging therapeutic area reaching a “tipping point,” it might act.

Roche’s M&A appetite in the past few years has been focused on its core priorities (oncology, hematology, rare diseases). It has done 5 deals since 2022, but has not made any notable moves in psychiatric therapeutics. Roche tends to favor building in-house capabilities (through research and partnering early) rather than buying late-stage assets in areas it exited. It will acquire when strategically required – e.g. it bought Spark to get gene therapy know-how, Ignyta for oncology, etc. If Roche perceives psychedelic therapies as a burgeoning field that fits its neuroscience franchise, it could act, but so far there’s little indication of that.

BI’s approach tends to be to develop novel small molecules in-house or via partnership rather than acquire late-stage assets and has completed 4 smaller deals since 2022. If it were to pursue a psychedelic therapy, it has the scientific acumen but might prefer “optimized” versions (non-hallucinogenic analogs, etc.) consistent with its focus on receptor pharmacology.

Disclaimer: The authors are the Co-founders of atai Life Sciences (ATAI) and Compass Pathways (CMPS) and hold a financial interest in these and other biotech companies. This analysis is for educational purposes only and does not constitute any financial or investment advice.

Really intresting analysis on Lundbeck's position here. The fact that they just dropped $2.6bn on Longboard and now have 2.3x EBITDA leverage makes it tough for them to be agressive in the space short term. But given their 70 year legacy in psychiatry, they seem like one of the most natural fits culturaly for psychedelic therapies even if they have to sit on the sidelines financialy for a bit. I wondor if they'll lean more into partnerships like they did with Otsuka rather than trying to acquire anyone else in the near future.